Most shareholders cast their executive compensation advisory vote based on an assessment of pay and performance alignment. Accordingly, in addition to required CD&A disclosures about program objectives and elements, including if material, “specific items of corporate performance ”considered by the compensation committee under Item 401(b) of Regulation S-K, it is also necessary to explain the rationale for selecting certain metrics for the company’s incentive plans and why they are important performance indicators given the company’s unique business and its strategic goals. Given the importance of metric selection, we have noticed recent efforts to make this disclosure more prominent, including use of headers or even dedicated sections.

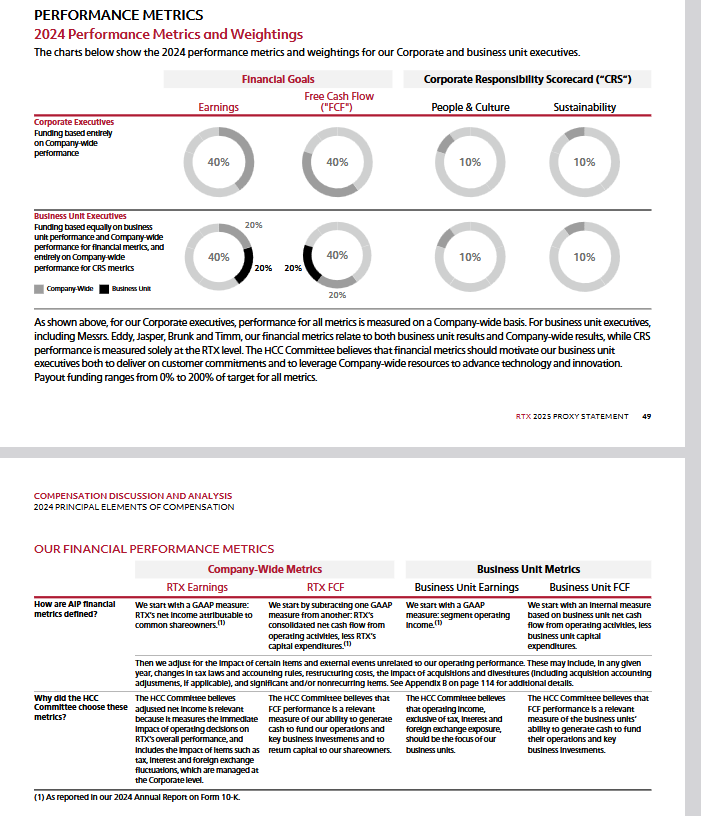

Here’s an example from the 2025 Intel proxy:

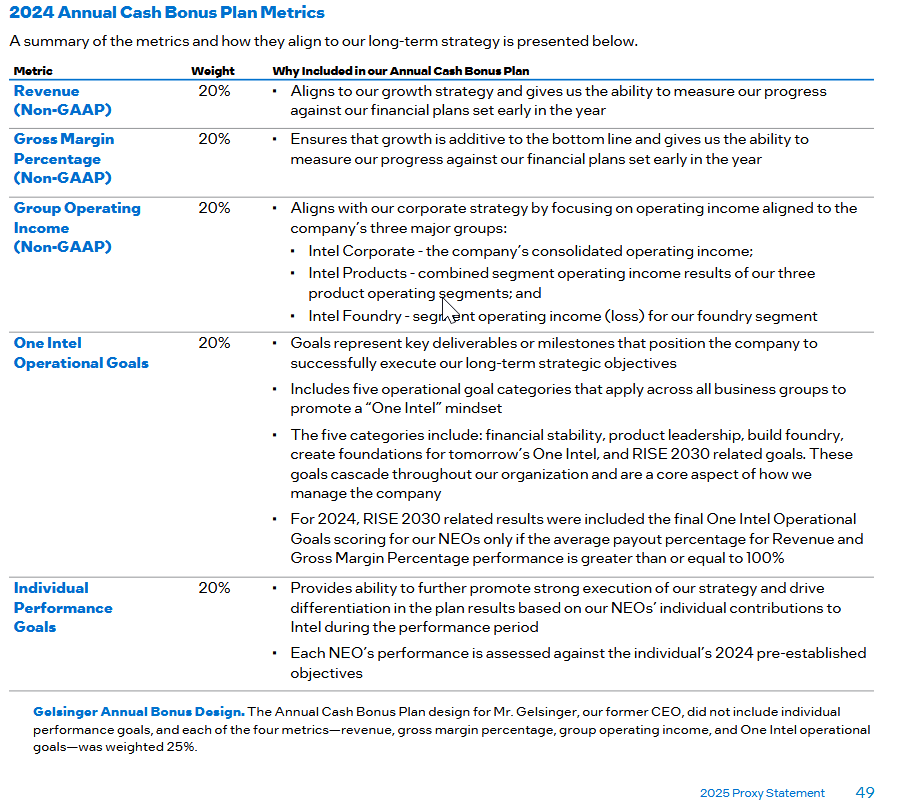

And here’s an example from the 2025 RTX proxy: