This was such a great panel of in-house practitioners – featuring Healthpeak Properties’ Carol Samaan, Lumen Technologies’ Michael Rouvina and Cognizant’s Aya Kiy-Morrocco – that I’ve decided to highlight their commentary in a series of blogs. This particular blog addresses the question of: “When you’re working on brand new disclosure – some new development or a new rule requirement – what is your recommended process for starting? Bulleted outlines, reviewing other sample disclosures?”

- Healthpeak Properties’ Carol Samaan – When there’s new disclosure that we need to draft, I’ll typically first start by reading the rule itself and looking at the adopting release or the background to it as there’s often a lot of interesting context that you can find in these.

Then I’ll prepare my own outline that I share internally with the team. I’ll also look at client alerts, and then following that, I’ll go try to find some sample disclosures. I try to look at the companies who are leaders in the space and look at what they’re putting out there if we find early filers. We take a look and then we start to develop our disclosure from there. - Lumen Technologies’ Michael Rouvina – I take a very similar approach to what Carol mentioned. I like to get my hands around the new rule or development – and then put together an outline or framework about how I envision the disclosure looking in my mind.

If it is a new development or a new rule, I tend to initially look to samples that either the Society for Corporate Governance or TheCorporateCounsel.net puts out. If it’s just something that we’re looking to update and refresh, that’s typically when I’ll research some peer companies and see what their disclosures look like.

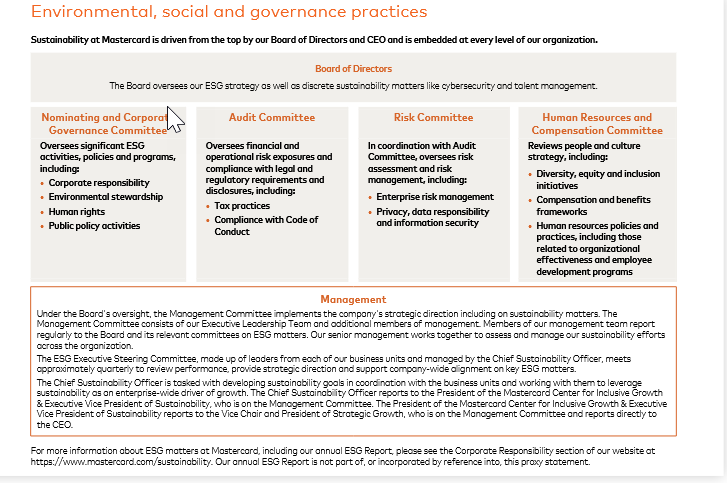

Once I have an idea in my mind about what I want to put on paper, I’ll engage – with our internal stakeholders. As much as I like to pretend that I’m an expert in all areas, it’s really important to talk to your internal business partners. - Cognizant’s Aya Kiy-Morrocco – I do want to build on what Carol and Michael said. Definitely read the rule first. With ESG reporting, the landscape is changing so quickly and a lot of folks are worried because there aren’t many guideposts to look at along the way.

I generally recommend leaning away from transparency for transparency’s sake. What I recommend doing first is a stakeholder priority assessment because you want to really understand what the expectations of your stakeholders are.

And you also want to tie your disclosure to your overall company strategy and so a stakeholder assessment can give you a lot of insight into what makes sense for you as an organization. What makes sense as far as who your stakeholders are and what they want to see from you – and then you can go ahead and focus on the areas that come up as priorities. The areas that are most important, so you don’t end up spinning your wheels and going in circles.