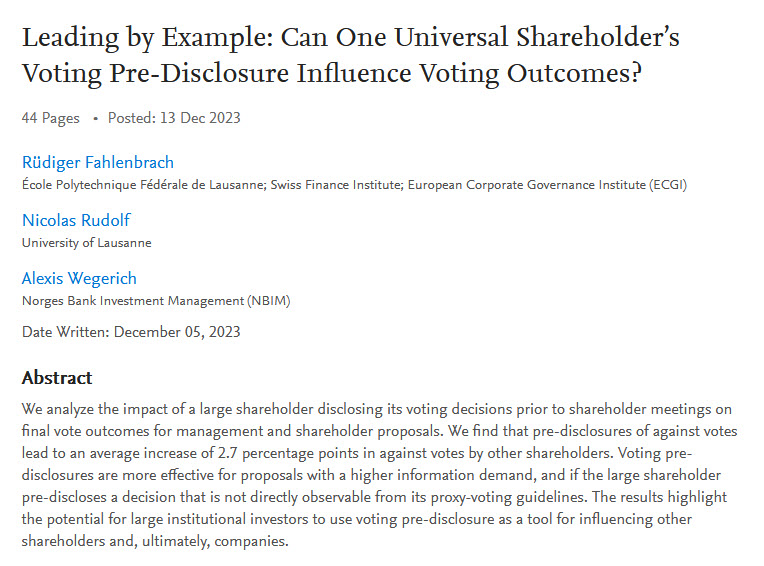

Transparency for fund voting. I found this blog by Jim McRitchie – on his long-standing CorpGov.net – to be fascinating. Jim’s blog covers this new study entitled “Leading by Example: Can One Universal Shareholder’s Voting Pre-Disclosure Influence Voting Outcomes?” that finds that Norges Bank Investment Management (NBIM) has already gained influence after deciding to pre-disclose its proxy votes (typically 5 days before AGM) beginning in 2021. Jim’s blog also reviews the other efforts over the years to push funds to pre-disclose their votes.

Here is the abstract about the study: “We analyze the impact of a large shareholder disclosing its voting decisions prior to shareholder meetings on final vote outcomes for management and shareholder proposals. We find that pre-disclosures of against votes lead to an average increase of 2.7 percentage points in against votes by other shareholders. Voting pre-disclosures are more effective for proposals with a higher information demand, and if the large shareholder pre-discloses a decision that is not directly observable from its proxy-voting guidelines. The results highlight the potential for large institutional investors to use voting pre-disclosure as a tool for influencing other shareholders and, ultimately, companies.”