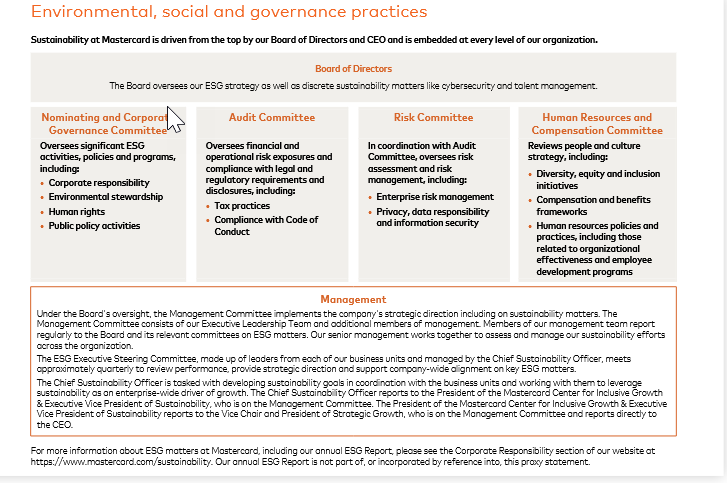

When it comes to ESG reports, things are quickly evolving. At blinding speed. From regulatory requirements to stakeholder expectations. From resource allocation internally to process improvements, including tools to assist those that need to prepare the reports.

Here is a list of the top questions that we hear from people that are preparing these reports:

- What are other companies doing? – As I blogged before in the proxy context, this is a question that people always ask.

- Which digital tools should I consider using? – With ESG reporting becoming big business, it was inevitable that the cottage industry of ESG reporting tools would explode. That’s great news as it’s a process that needs digital tools to simplify the process and make it more time effective.

The bad news is that many of the providers are brand new and their services need to mature. And it’s hard to tell which product does what – and whether it meets the needs of a particular company. It’s truly a jungle out there and I’m not sure when this problem will abate. Probably not anytime soon. - When will the SEC adopt final climate disclosure rules (and what will they look like)? – The SEC had hoped to initially adopt final rules by the end of 2022. Then the spring. Now the rumors are it will be sometime in the Fall – so it could be any day now. There has been some indication that the SEC will water down what it has proposed (for example, not requiring Scope 3 emissions disclosure) – but what that ultimately might look like is unknown.

- How can I most easily keep up with all the regulatory changes? – Things are moving so fast on the regulatory and stakeholder front that one could spend all day just reading up on the latest developments.

But those writing the reports don’t have all day to read. So they must rely on others to give them the latest in a concise and practical way. Not many resources – if any – are out there yet that offer that kind of practical guidance.

This year’s largest batch of questions related to the changes GRI made to its framework. Now there are a bunch of questions about the CSRD in Europe (see our new video about “10 Surprising Things About the CSRD). Next, it will be the ISSB standards. The SEC’s final rules will play a huge role in this regulatory havoc when they arrive…