It should be no surprise that the top question that people ask those that work at Labrador is: “What are you seeing? What are other companies doing this season?” Given that Labrador assists a good chunk of the S&P 500 with their proxy and 10-K, they are in a unique position to answer that type of question as the proxy season bears down.

And this is all why next Tuesday’s 5th Annual “Transparency Awards” is so important. You’re going to want to see what the most transparent companies are doing. Those that set the bar that we all should be striving for. [And to be clear, even though Labrador hosts these annual awards, plenty of clients from other firms win some of these awards – it’s truly an objective process.]

It’s not that companies necessarily want to push the envelope. Many are quite happy to be in the middle of the pack when it comes to disclosure practices (and it’s possible to do this and yet be quite transparent – the slippery slope upwards, a topic for another blog). Recently, I made this point in a Public Chatter blog entitled “What Are ‘Best Practices’ Anyway? (and the companion blog “In-House Corner: What Are ‘Best Practices’ Anyway?”).

In fact, the primary reason why this question is so common is that people want comfort that they’re not going to fall into one of the two extremes – disclosing too much about a particular topic or disclosing too little. They don’t want to stick out. After years of the proxy being primarily a regulatory, rules-driven document, there is still some residual hesitation about voluntary disclosures. But is there more risk in NOT making disclosures that peers are including?

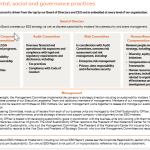

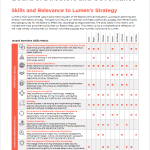

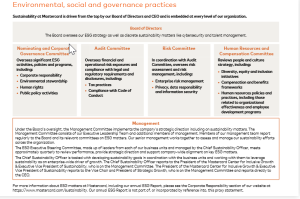

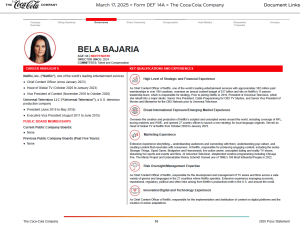

Other types of advisors tend to provide guidance about the black letter law. Advisors like Labrador are more in the business of laying it out in practical terms. “What types of graphics might work best for which types of disclosures to improve readability? Where might this type of disclosure best fit within the proxy to help explain the company’s approach or perspective? Within the 10-K? Does it make sense to mention this item in the proxy summary to provide context for other disclosures?” And much more.

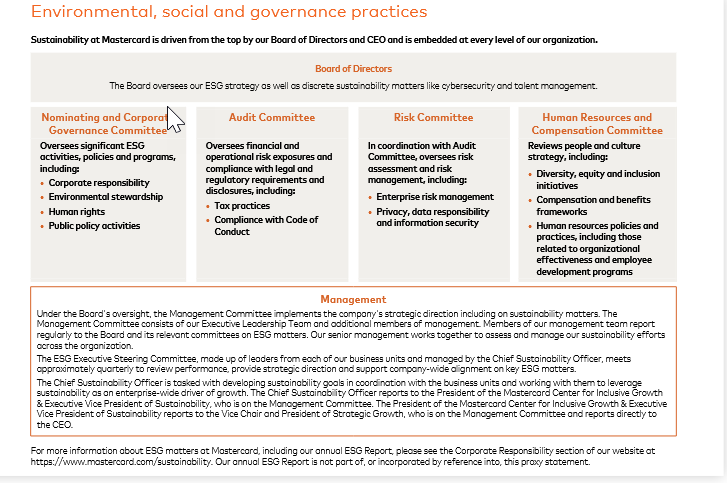

This is about accessibility of information. As a reader, I shouldn’t have to go look at another document to understand the key messages in the document I am reading. For example, in a proxy, providing a bit of a company overview plus performance highlights (strategic, financial, ESG, etc.) helps provide the reader with context for the other proxy disclosures.

While performance highlights in proxies became common due to pay vs. performance/comp disclosures (and why for years these disclosures primarily were found at the beginning in CD&A), performance also is applicable to board elections. When making voting decisions, the reader asks, “Am I pleased with the direction of the company and satisfied with the board’s oversight of strategy, risk, and leadership decisions?”

For a short and sweet example, see the 2023 Walgreens Boots Alliance proxy (on pages 6-7):

For a longer example, see the 2022 Accenture proxy (pages ii-vii):