Companies generally want to show that they are actively engaging with their shareholders year-round in their proxy. While quarterly earnings calls, investor conferences, and conversations with investor relations and management are ongoing, the primary focus of proxy statement disclosure has been around documenting the who/what/when of the governance outreach program (although some companies also include an overview of their investor relations calendar).

The “when” component of the disclosure led to a common graphic showing governance engagement efforts during each of spring, summer, fall, and winter. Recently, this graphic has moved away from emphasizing the seasonality of engagement to instead focus more on how each outreach campaign aligns with the board’s calendar and its consideration of feedback.

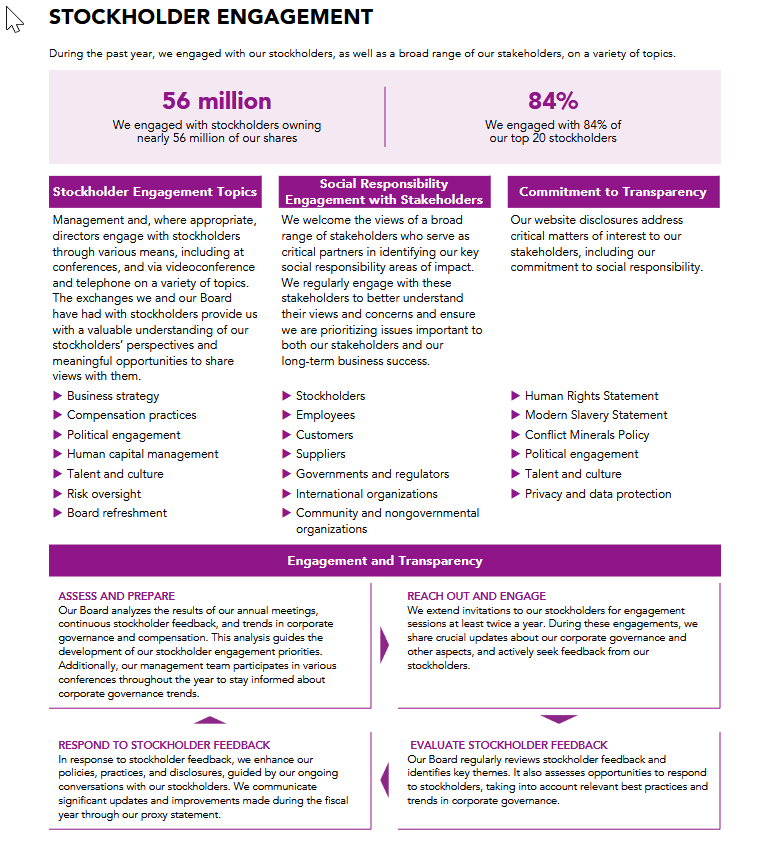

Here’s an example from the 2025 Leidos proxy:

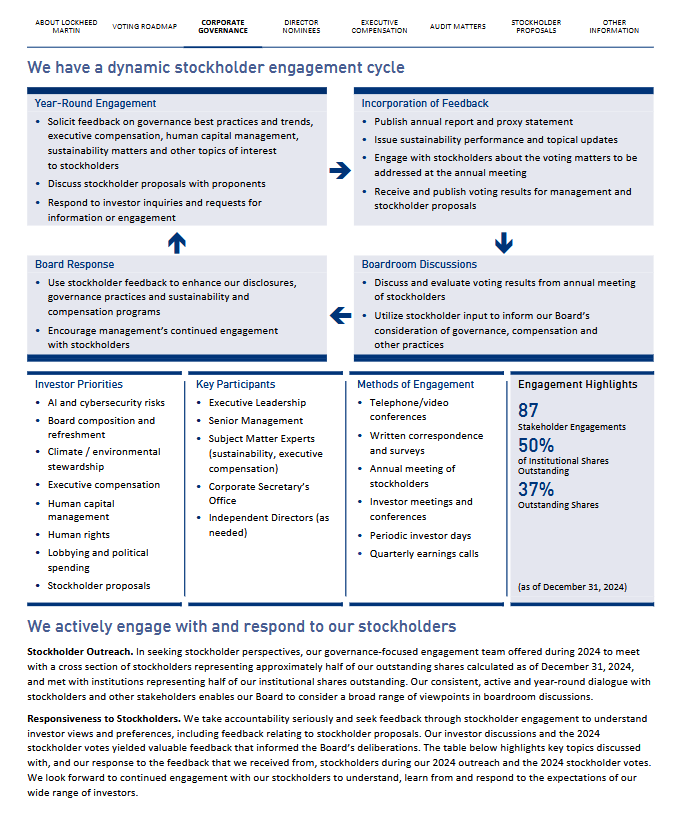

And here’s an example from the 2025 Lockheed Martin proxy: