Following up on this Part 1, these eight things can help you understand what “transparency” is – and isn’t:

- Transparency is all about trust – Transparency is an essential condition for building and keeping lasting trust. Transparency requires timeliness. Transparency gives investors the information they need to make an investment decision. (This sounds obvious, but many people in the corporate governance world seek transparency for purposes other than making investment decisions.)

Transparency is particularly important in an age of increasing misinformation, disinformation, and what one could call “artificial information” (e.g., news articles generated entirely by “artificial intelligence” bots). - Transparency pays off – Although transparency can have negative effects in the short term, research shows that it always pays off in the medium- and long-term. Transparency adds to a company’s valuation.

- Transparency can be a rallying mission – Transparency makes it possible to bring companies and their audiences closer, and even grow morale within a company because employees feel more connected to companies that are truthful with them. Transparency (just like opacity) is a part of corporate culture.

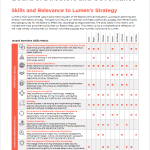

- Transparency can be measured – Although transparency originally belonged to the field of morality; it is now a science. A set of universally recognized techniques can be applied to objectively measure the transparency of information.

- Don’t confuse “transparency” with “disclosing everything”; It means being honest about what you do disclose – Transparency doesn’t necessarily mean disclosing “everything” (i.e., a great mass of details). In fact, disclosing too much is actually a good way to obscure what’s important. It does mean being complete and candid in what you do disclose and presenting information in a way that is decision-useful to the reader.

Transparency must be purposeful. It must be deliberate and thought through. Disclosure merely for the sake of disclosure does not add value. Of course, it can be hard to disclose news that doesn’t reflect well on a company, and many inside the company may want to gloss over it or only include it in the numbers or in aggregate form somewhere – or maybe not even disclose it at all.

But if there is a negative development in the executive pay program, for example, you build a lot of trust by describing it clearly and putting some context around it. Or if a performance metric that you typically use in business highlights is negative, be honest and explain the downturn rather than changing the metric. It may require good communication skills and a bit of persuasion from you as the primary draftsperson with those in the C-suite and in the boardroom to make the disclosure transparent, but it will build trust in the company.

“Materiality” is a nebulous concept in some cases. And often used as an excuse to not disclose something that stakeholders would want to know. In some cases, transparency means going beyond merely disclosing what is considered compliant with government regulations. And beyond what some might argue is traditionally material. - Transparent disclosure is easily understood – Transparency consists not only of disclosing information, but also making it readily intelligible to the reader. Transparency means informing the reader’s judgment by providing all relevant facts in the most accessible form (including clear prose, graphics, tables, bullets). Transparency means providing insightful analysis, not just data. It means explaining, not just telling. Transparency requires context, not just content.

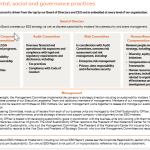

Delivering disclosure that is transparent necessitates the appropriate processes and controls. It must be organized and coordinated. Different leaders of the same company saying conflicting things undermines transparency. So too does selective disclosure. - Transparency isn’t easy, but it’s doable – It is within the reach of any company. But it requires real commitment, real effort. If a company is not transparent, it may well have decided it does not want to be. That company is losing out on an opportunity to build real value.Transparency happens on a continuum to paint the entire picture as it develops over time. Transparency must happen with consistency, not on an ad hoc basis.

- Transparency has enemies, requires courage and might help prevent scandals – Transparency requires courage when it is tempting to obfuscate or spin what will inevitably be found out as nonsensical malarkey. Call it what you want. It is often not easy to acknowledge that everything within your company is not perfect. Humility clearly expressed creates sympathy; it makes your good news more believable.

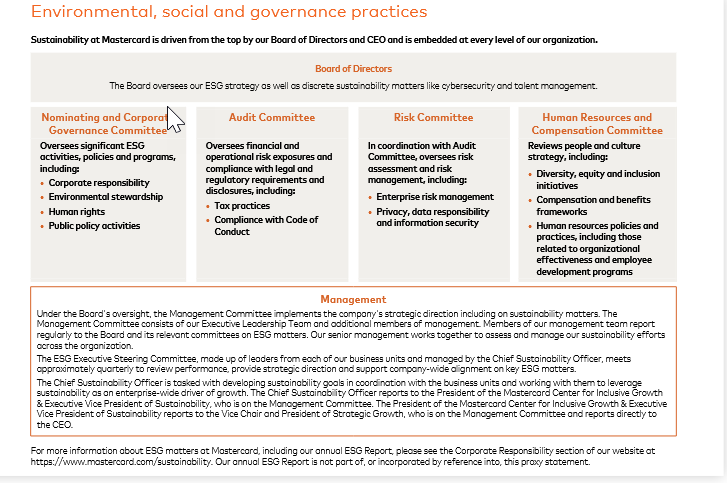

Much has been done to promote and ensure the transparency of financial disclosure; but everything remains to be done to increase the transparency of non-financial information – particularly when it comes to ESG information that stakeholders and regulators want to hear so much more about.

Transparency happens above board and out in the open. Leaking information is not an act of transparency. A culture promoting transparency can expose issues earlier, allowing them to be addressed and disclosed – and help prevent situations that otherwise might turn into scandals that can’t be contained.