Recently, I came across a nifty new free Edgar retrieval site called “KFilings” and I asked the guy who launched the site – Andrew Jennings (who is an associate professor for Emory Law School) – these questions:

- What led you to launching KFilings?

A few different threads inspired KFilings.

The first thread is that at different stages of my career, whether as a law professor, a practicing attorney, or an expert witness, I’ve needed to monitor Edgar filings for some company of interest. Maybe there are proxy filings I’m keeping an eye on, some development I expect to see in an 8-K, or so on. There are commercial Edgar tools that would allow me to create email alerts for those filings, but they’re somewhat tedious to use, so I would just check the SEC’s Edgar site manually.

Sometimes I’d check multiple times a day. What I wanted though was a simple tool that I could quickly use to create Edgar email alerts for particular companies and/or filing types. So in some ways, this is a tool that I created for my own use.

But what really got the project going was conversations with friends in practice. In-house lawyers, corporate controllers, and investor-relations officers might not have access to the commercial Edgar tools that law firms and academics have, but they want to keep up with what their peer group or competitors or counterparties are filing. I worked with them to design something that was simple to use and streamlined enough that I could offer it as a free service.

2. How does it work?

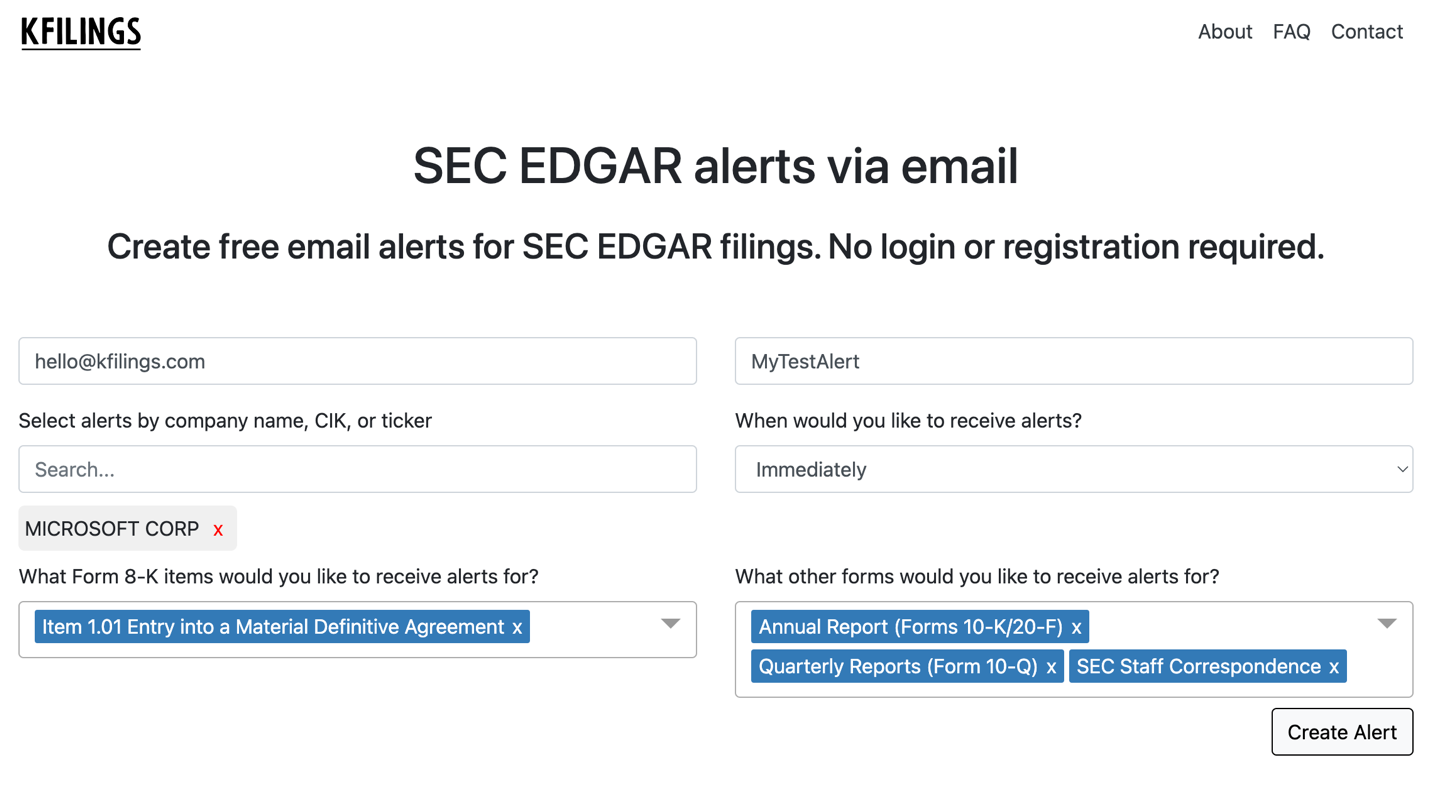

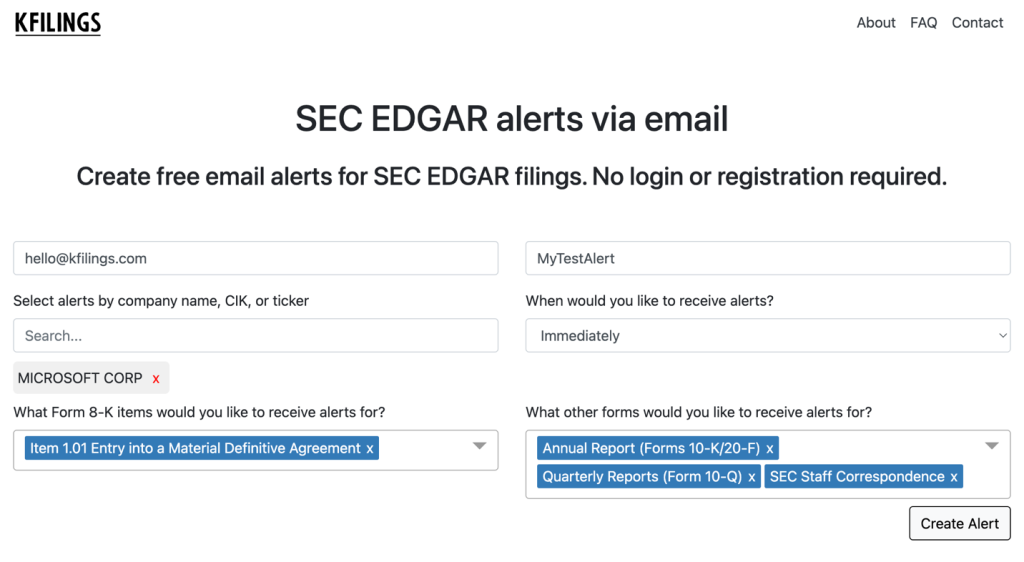

KFilings is a one-page web app for setting up free SEC Edgar alerts. To create an alert, go to kfilings.com, type in your email address, supply an (optional) name for the alert, choose the companies you want to get alerts for (by name, CIK, or ticker), pick the kinds of Form 8-Ks or other filings you want, and select how often you want to get the alerts (immediately after a filing – or as a daily or weekly digest).

You don’t actually have to limit the alert to any particular company. For example, if you’re interested in cybersecurity disclosures generally, leave the company field blank and just pick Item 1.05 8-Ks (which is used to report material cybsersecurity incidents).

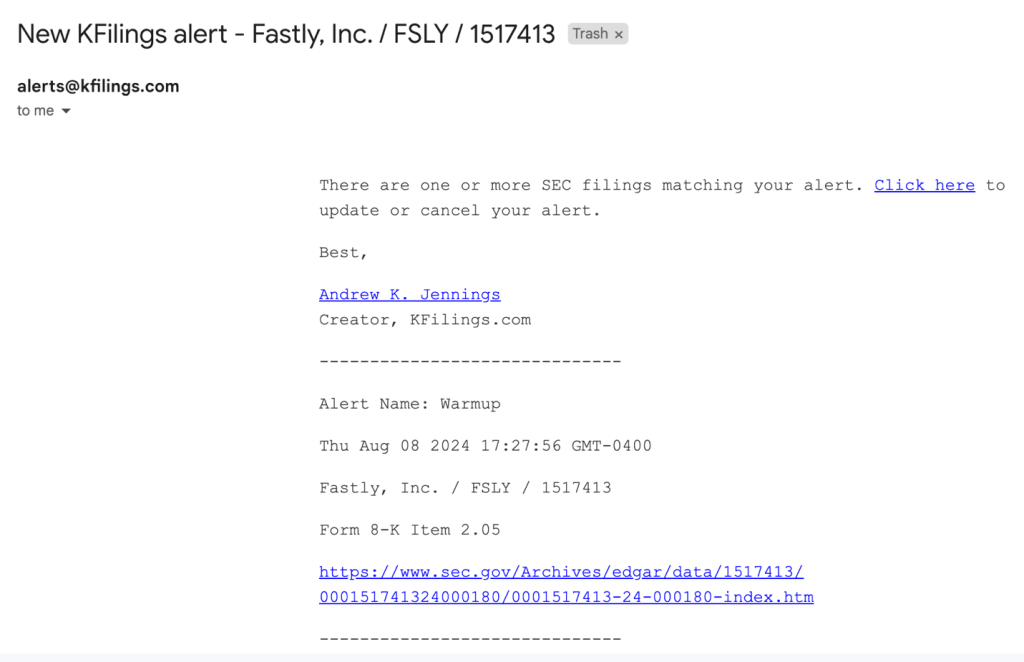

The alert emails themselves have a minimalist design, with just plain text about the filing and a link to it on Edgar. My goal was to make the emails easy to quickly scan and read on a phone.

After you create an alert, you will receive a confirmation email. Part of the tool’s simplicity is that there is no registration process, nor passwords or logins. Instead, the confirmation email – and any alert emails – will include a unique link that you can use to update or cancel the alert.

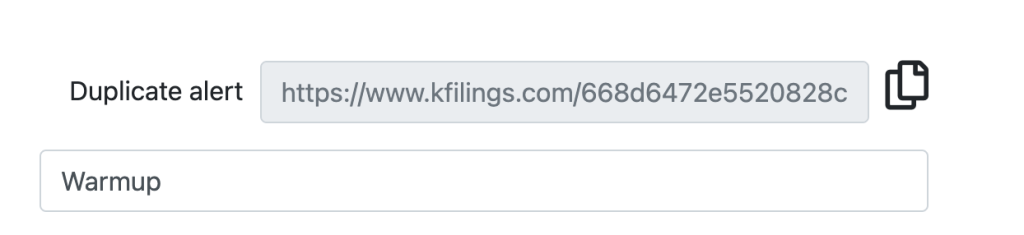

When you click that link for an existing alert, you will also see in the upper-right corner a “Duplicate Alert” link. You can share that duplicator link with anyone else and it will let them recreate the alert for themselves.

The duplicator links also allow me (or anyone else) to offer alert templates. For example, here is a template pre-loaded with sixty-seven AI-related companies. In the coming weeks, I plan to post new template alerts for major indices. But anyone can create a template and share it with others.

3. How hard was it to build?

It was a bit harder than I expected going in. I started designing the tool at the end of last year, including researching other Edgar tools, how the SEC disseminates Edgar data, and getting feedback from target users. The initial idea was to focus just on 8-Ks, because getting those in real-time is often particularly useful and it would simplify the project for me to just focus on one type of disclosure.

I eventually expanded it to also cover Staff correspondence, registration statements/prospectuses, annual reports, quarterly reports, foreign issuer reporters, ownership filings, proxy filings, tender offer filings, and Rule 144 filings. There are dozens and dozens of form types that fall into those buckets, so it took a while to build out and make sure they were all being picked up.

I soft launched the tool in June and there were some bugs early adopters helped me spot and fix. The biggest issue was that correspondence (whether from the company to the SEC Staff or vice versa) was not being picked up. Correspondence was tricky because it becomes publicly available a month or more after its filing date. Olga Usvyatsky, the former vice president of research at Audit Analytics, flagged the issue and was very generous with her time as I solved the problem.

4. What is the technology behind it?

Technology-wise, KFilings is fairly simple. The SEC provides a real-time public data feed for Edgar filings. KFilings pulls filings from that public feed and matches them to user-created alerts in a database.

If there is a filing that triggers an alert – and the user has requested an immediate alert – then the tool sends an email with just that filing. If the user has selected a digest option, the tool will hold the filing and send it out with all other relevant filings on a daily or weekly basis.

5. What are the most common searches on it so far?

Item 1.05 cybersecurity 8-Ks have been big thus far. I’m also getting feedback that in-house lawyers, accountants, IR officers, and others are using KFilings to keep an eye on their peers and competitors, or even just their own company’s filings.

I’ve been surprised by the uptake from external professionals. I wasn’t sure whether lawyers or accountants, or other professionals, working in outside firms would use KFilings. After all, they have access to commercial products with alert functionality and so much more. But when I pose that question to external professionals, I get a response along the lines of “I’m sure we have that expensive commercial product, but I don’t know my password and I’m too busy right now to learn how to use it. KFilings is simple and works immediately.”