I just wrapped up reading Matthew Sekol’s “ESG Mindset: Business Resilience and Sustainable Growth.” (You can also buy the book on Amazon – the other link takes you to the publisher’s site. Support Indie publishers!)

It’s a “must read” for anyone in the ESG space for a number of reasons. Matthew works for Microsoft as a Sustainable Industry Advocate and comes at the topic from a place that many of those reading this review comes from: inside the business world and knee deep in having to grapple with a fast-moving field that is just in its infancy. Matthew is also all about doing the right thing for the right reasons. And that’s what “transparency” is all about – building real-term value by communicating clearly and honestly.

It’s particularly valuable for those that haven’t lived deeply in the ESG space yet but are being introduced to it now – and will be involved in it either in a leadership or reporting role. It’s a practical – and easy read – for board members, C-Suite officers, those in the ESG reporting food chain and anyone else that will be supporting the data collection and disclosure initiatives that will now be mainstream for most companies.

Here are a dozen of the many nuggets in the book that struck my fancy:

- Right off the bat in the Acknowledgements, a good argument for understanding why “Everything for ESG.”

- The focus on finance reduces ESG’s effectiveness. Collection of ESG data is as important as the collection of data for financial reporting purposes.

- “ESG data” can be defined as material information for stakeholders, which if omitted, would have caused them to make a different decision, regardless of the materiality or impact context.

- Companies should leverage their ESG data to use it as a valuable and renewable resource to create long-term value and for growth. Don’t think of ESG as just a compliance and cost exercise. It’s a governance risk if you have that mindset.

- A company’s internal systems contain all sorts of quantitative metrics that require additional context to help determine materiality and impact. These metrics go beyond just emissions; it should address any issues that are relevant to a company’s business and goals.

- “You can’t manage what you can’t measure” isn’t a true maxim. You don’t need to have all the data you think you need to start leveraging what you have so far.

- “Social” is the linchpin of ESG. It’s in the middle for a reason. Human capital. Customers and potential customers. The “E” can’t be split out from ESG because all three are so important.

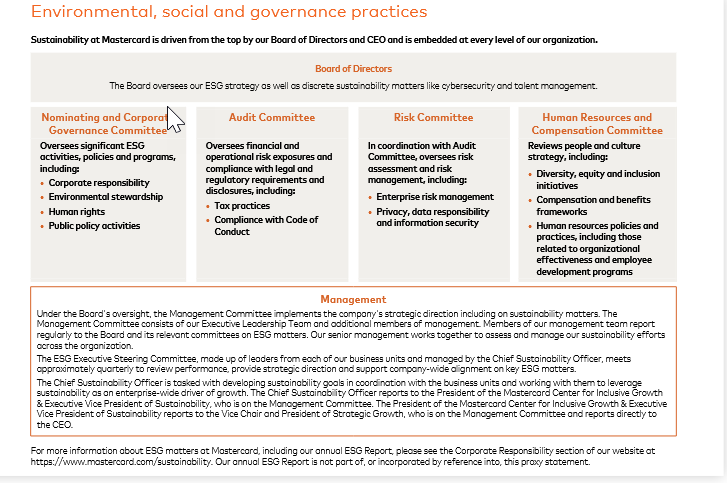

- The lack of ESG expertise on the board is a real risk. You lose long-term focus. The members of the board also likely wind up with a lack of agreement on what ESG even is.

- “Stakeholder mapping exercises” are a good thing for the board and senior managers to be conducting to help set the company’s strategy.

- Think of technology like the rest of ESG as technology is inextricably linked to business. Think of “legacy” technology within your company as a transition risk. Technology is complex and rife with ESG-like risks. Take AI for example

- There are a myriad of “Use Case Examples” in the book that bring the concepts brought forward to life.

- The back half of the book has analysis about the future of ESG and a description of the criticisms and controversies. There also are a bunch of practical steps you can take to improve and innovate in your business using ESG.