This Wachtell Lipton memo from Marty Lipton, Zach Podolsky, Mark Stagliano and MacKenzie Thurman is worth reading: “In March 2024, the UK Investor Forum presented the results of its six-month assessment undertaken to identify, understand and evaluate the ways companies and their institutional investors exchange strategic proposals. The project involved a series of interactive events designed to facilitate informative and open discussions among leaders from public companies in the United Kingdom and their counterparts at asset managers and investment funds. While the Investor Forum assessment focused on UK-listed companies and their institutional investors, its findings are relevant for public companies around the world.

A fundamental thesis underpinning the work of the Investor Forum—that communication channels used by companies and their investors must evolve alongside ever-shifting market interests, dynamics and objectives—aligns with the governance, engagement and stewardship principles of stakeholder governance adopted by the Business Roundtable and the World Economic Forum, and fits well with the purpose of companies compellingly addressed by Colin Mayer in his new book, Capitalism and Crises: How to Fix Them (Oxford University Press, 2023).

By highlighting the role that effective communication between investors and public companies can play in driving sustainable, long-term value creation for the benefit of all stakeholders, the Investor Forum contributes to a growing body of academic work and real-world practices that rejects the shareholder primacy arguments of Milton Friedman that have until recently dominated academic thinking on corporate purpose.

Within the overarching purpose of sustainable long-term value creation, the work of the Investor Forum confirms that companies and their investors benefit from tailored and adaptable communication channels rather than formulaic governance structures and one-size-fits-all reporting mechanisms. The Investor Forum found that, when available, investors use these bilateral communication channels to connect with and understand a company’s stated mission, evaluate its performance against that mission and provide real-time, constructive feedback to the company’s leadership. In turn, a company benefits from dedicated forums for communicating and developing a strategy aligned with its core values yet responsive to market dynamics and the priorities of its investors.

Importantly, the work of the Investor Forum shows that when companies and their investors have opportunities for meaningful dialogue, they are more likely to realize their common goal of sustainable long-term value creation, without doing damage to corporate stakeholders. As a result, they can more effectively work together to identify and implement strategies in pursuit of this goal and resist short-termism. Mutual commitment to this approach builds deep-rooted relationships that allow the exchange of strategic proposals and improve long-term results, deterring much of the damage done by activists that instead seek short-term profits.

Consistent with the promise of the stakeholder governance model, the relationships created by the Investor Forum enable a private-sector solution to attacks by short-term financial activists and the short-termism that impedes long-term economic prosperity. To that end, the Investor Forum’s assessment highlights a number of challenges for establishing these relationships, including expanding regulatory regimes that impose ever-increasing disclosure obligations that consume resources and result in the publication of information that is at times of questionable value to investors, reflexive “vote no” campaigns in place of genuine engagement between investors and the companies in which they are invested, and risks relating to engagement for its own sake rather than for a strategic purpose.

The Investor Forum did not stop at identifying the challenges facing public companies and institutional investors. Furthering ideas suggested by proponents of stewardship and engagement frameworks, the Investor Forum has also proposed practical, actionable steps for companies and investors to overcome friction entrenched in four evolving aspects of the investor-company relationship: (i) investor relations; (ii) sustainability; (iii) audit and assurance; and (iv) voting and governance.

- Investor Relations. A public company should use its investor relations function to build a compelling equity thesis that helps investors connect with the company’s vision, purpose and strategy. Given the heterogeneity of investor and stakeholder bases, the Investor Forum advocates for companies to tailor engagement strategies and reserve space for investors to share their views and ask questions. Correspondingly, investors should contribute by clearly expressing priorities on key issues of interest and investing time to understand the nuances behind the numbers and metrics presented by companies.

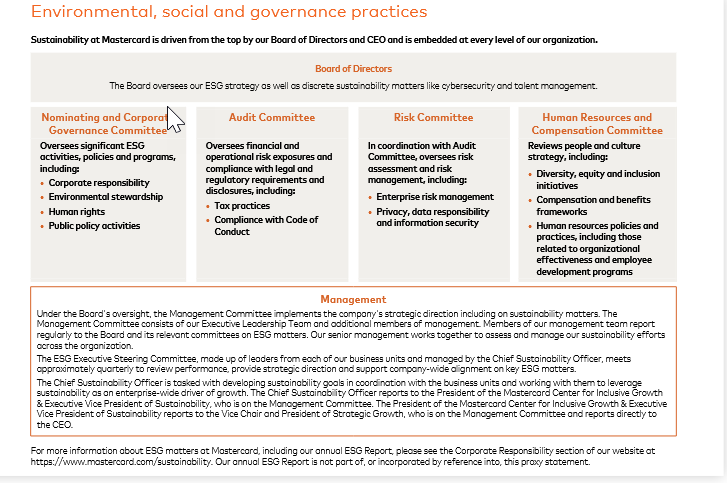

- Sustainability. The Investor Forum finds that strict adherence to inflexible ESG reporting regimes can shift the focus of companies and investors away from the real-world impact of sustainability initiatives, thereby often reducing their effectiveness. Accordingly, the Investor Forum suggests consistency and standardization across data metrics and clear disclosure of the assumptions underlying such metrics, with a focus on what is most important to a particular company in its specific context. In this way, companies can articulate the purpose behind sustainability initiatives that align with their strategic objectives and provide data for investors that is relevant to their decision-making.

- Audit and Assurance. The Investor Forum finds that discussion of audit matters is a relatively underdeveloped communication channel for companies and their investors, and recommends enhanced openness and two-way communication between audit committees and investors in light of the importance investors place on the integrity of public company financial and other disclosures.

- Voting and Governance. The Investor Forum perceptively notes that various dynamics, including the role of proxy advisors, emerging climate and ESG concerns and heightened pressures on asset managers from interest groups, have made shareholder meetings a more challenging venue for collaboration between companies and their investors. Further, isolated and binary voting opportunities are not an appropriate substitute for thoughtful discussions and effective engagement regarding mutual long-term interests and stewardship of companies. Companies should clearly communicate policy changes and related rationales, and investors should likewise clearly communicate their expectations on salient issues and disclose the process behind voting decisions, including the roles of any proxy advisors.

The well-founded proposals made by the Investor Forum in this report, which apply well beyond participants in the UK market to those in the United States and elsewhere, recognize the fundamental idea that it is critical for companies and their investors to partner through strategic, effective engagement to achieve sustainable long-term value creation.”