Ah, it would be so much easier to draft the proxy if all you had to do was follow the rules. The SEC’s rules have been long familiar to many of us. While some of them change occasionally and new complexities are introduced, for the most part, they stay the same year after year.

What changes frequently are the expectations of the many stakeholders that a company has. Shareholder engagement has exploded the past ten years and the level of resources in a corporate secretary’s department to handle that hasn’t kept pace in most companies.

So when dealing with all these different stakeholder expectations about what they expect to see in the proxy, it can be challenging to decide what belongs in a proxy. And the extent to which a company should cover that particular topic. Each company has to prioritize what to disclose so that the proxy doesn’t balloon to double its size. Too much disclosure can nearly be as hazardous as too little.

Beyond the regulatory required disclosure, companies must decide what other topics to address in the proxy. Each company has its own history with each of its particular stakeholders – and that dynamic changes over time. Who’s asking and what is the significance of their voice?

And how important is the topic to which a particular ask is addressed at? If it impacts the election of directors, it will likely move to the top of the list. “We hear you loud and clear.” If the ask doesn’t touch much on the items to be voted upon at the annual shareholders meeting, it might be a low priority.

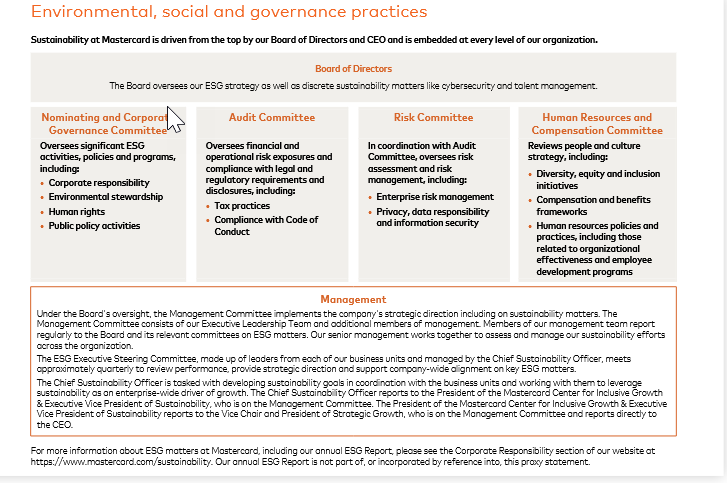

The consequence of that is a unique set of expectations upon that company that helps dictate what types of disclosures wind up in the proxy. How much ESG disclosure? Ethics? Lobbying and political contributions? The list of possible voluntary disclosures goes on and on.