Francis Byrd – Managing Partner of Alchemy Strategies Partners LLC – has seen it all, having worked at three investors (TIAA; State of Connecticut; New York City Comptroller’s Office – New York City Pension Funds); one rating agency (Moody’s) and two proxy solicitors.

In this 20-minute video, Francis joins us to discuss:

- Engagement seems to be the watchword for the relationship between investors and companies. How should companies view the “necessity” of engaging with investors?

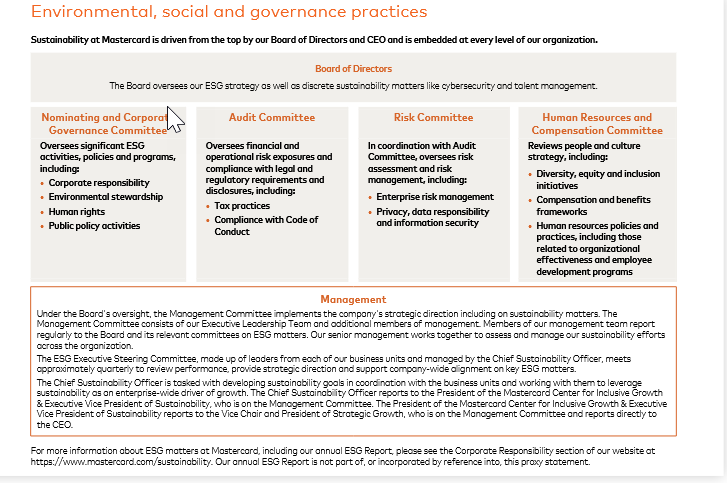

- Companies feel under pressure to develop various ESG programs and disclosure metrics. How might attorneys respond to boards/senior management requesting guidance?

- The establishment of an investor relations program is presumed to be a solid sword and shield for a company, but what role should outside counsel play in IR?

- Once an investor makes contact and requests a meeting with the CEO and/or board members, what is best way to go about prepping and handling such a meeting?

- How do you determine the true motivation for an investor who turns “activist”?