Transparency Criteria #44 for the proxy states:

The document includes a dedicated section, subsection or callout discussing the board’s role in oversight of human capital management.

Even though companies are required to include human capital management disclosures in their Form 10-K, this topic also is a critical component of the “s” of ESG so it should be addressed in the proxy. It’s part of making the disclosure easily accessible so that readers don’t have to dig elsewhere to find what they need when deciding how to vote.

As this is relatively new disclosure, location for this disclosure in the proxy is varied: human capital highlights may appear as its own section, a subsection of an ESG section or part of board oversight.

The summary should provide a general sense of workforce priorities. The disclosure itself often varies quite a bit from company to company as each company has its own culture. Their own way of engaging with employees.

The matters typically addressed in the proxy are those that are important enough so that the board felt a need to be involved with them.

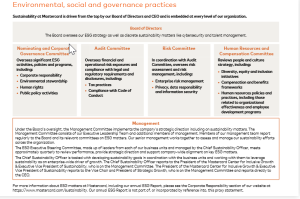

For example, see the 2022 General Mills proxy (page 8):

HCM Oversight

Transparency Criteria #41 for the proxy states:

The document has a dedicated section, subsection or callout discussing discusses the board’s role in oversight of human capital management.

The flip side of your HCM disclosure is also covering how the board oversees human capital management. This is often part of the Corporate Governance section covering the board’s various oversight responsibilities, but also could be in its own dedicated section or a subsection of the ESG section. Or even as just a callout in the proxy, perhaps as part of a “Risk Management” section.

With heightened attention on the board’s role in strategy and risk generally, it follows that we are seeing more discussion of board involvement in specific topics that fall under this umbrella. Many companies claim that “our people are our greatest asset” – explaining how strategy, risk and human capital management are viewed at the board level can demonstrate how all are interconnected.

Smart companies are incorporating and linking their ESG strategy (with its related board oversight) to their broader corporate strategy. They view these all as being inter-related. And if they consider this all together, they then disclose that they do this as part of one exercise.

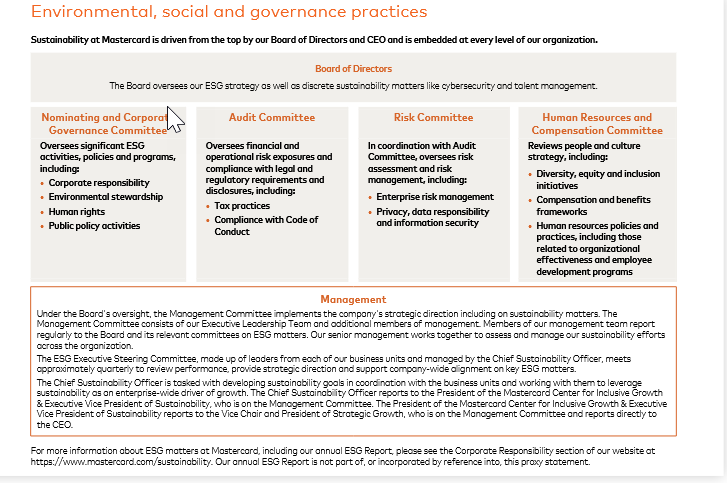

Some companies use a graphic to display how the board oversight of HCM works – which board committees cover which topics and which risk areas. And which topics are addressed by the full board. And which members of senior management and/or departments are involved in the oversight. This allows the reader to get a sense of whether these important topics are getting the attention it needs from the board and management.

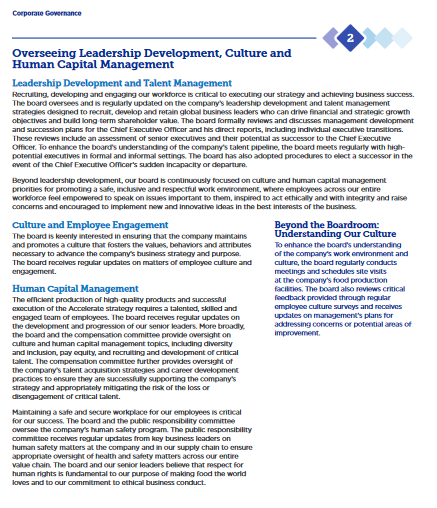

And here’s another example from the 2022 General Mills proxy (page 28):

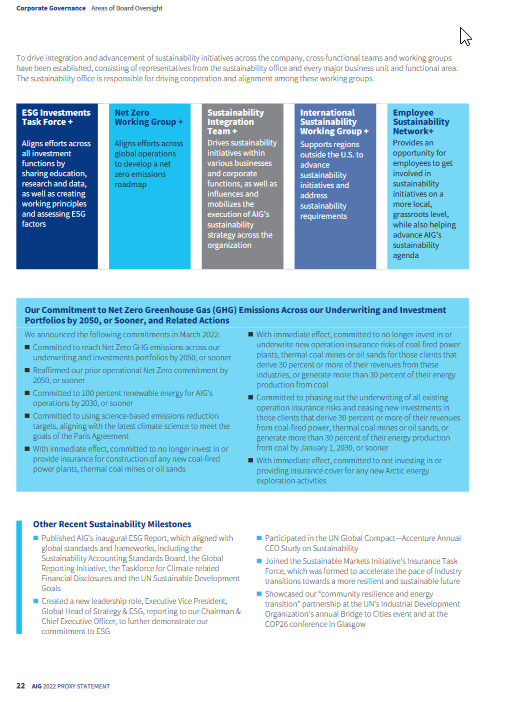

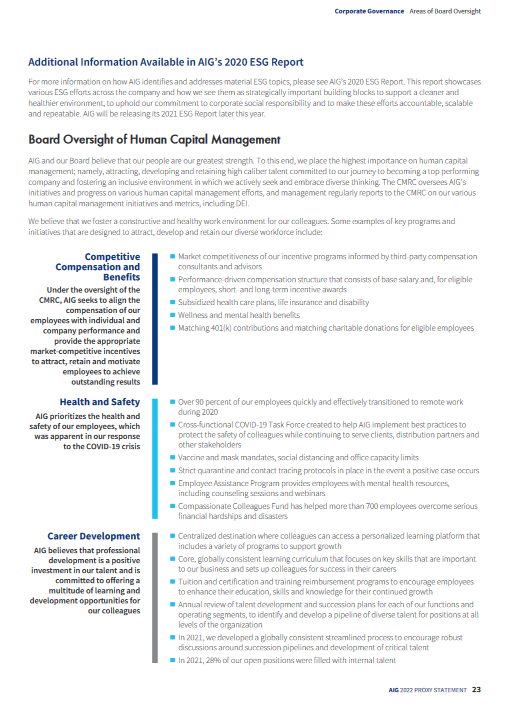

And for another example when the “highlights” and “oversight” discussions are combined, see the 2022 AIG proxy (pages 23-24):