There should be some sort of overview in the proxy about topics that are addressed in other corporate documents more thoroughly. These overviews typically cover things addressed in greater detail in the Form 10-K and ESG report. Often this comes in the form of one or more “highlights” sections, such as a “Company Overview” or a “Performance Highlights” section.

An overview helps provide context about the topics that tangentially might impact the items shareholders will be voting upon. If you like a little bit of history about disclosure practices, say-on-pay arguably led the charge for these “highlights” sections in the first place as companies sought to explain and calibrate pay and performance. Now we think about highlights more broadly and recognize that insight into the strategy of the company is relevant to shareholders considering the election of directors.

By providing a snapshot of the company’s bigger picture, the company allows the reader to get the gist without having to hunt down other corporate documents and weed through the nitty-gritty.

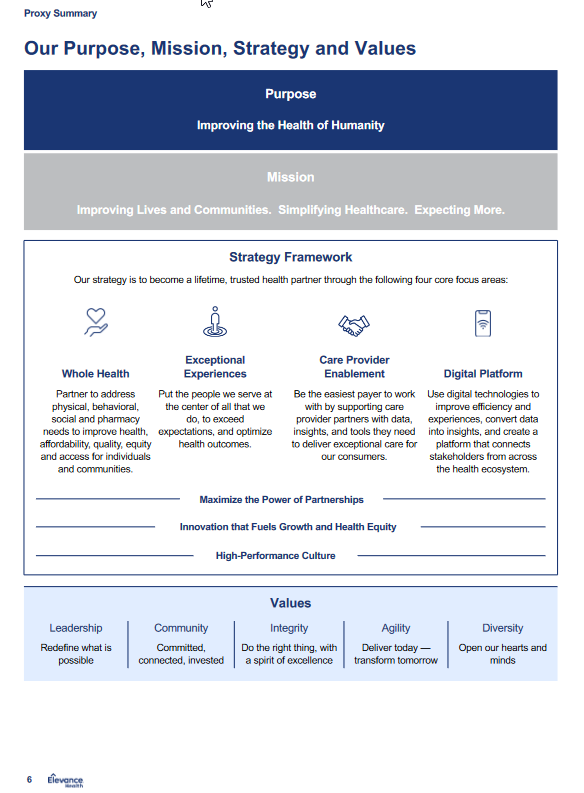

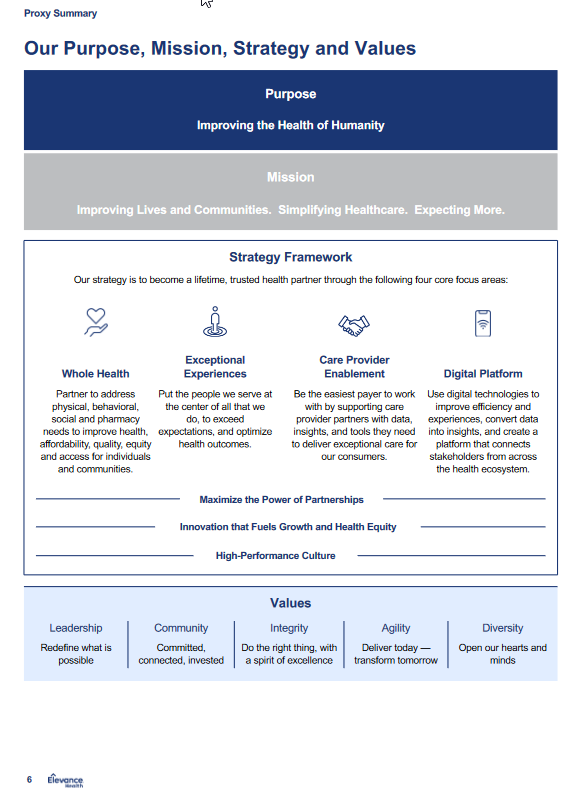

Mission, Vision & Purpose

Related to this is Transparency Criteria #13 for the proxy, which states:

The mission, vision or purpose of the company is presented within the introductory pages.

Sharing the company’s mission, vision or purpose up front gives insight into what matters most to the company and allows readers to evaluate whether there is long-term alignment with strategy and performance. The demand for this type of disclosure is reflected in the campaign a few years ago from BlackRock. In 2018, BlackRock CEO Larry Fink titled his annual letter “A Sense of Purpose” – and in it, he stated:

Without a sense of purpose, no company, either public or private, can achieve its full potential. It will ultimately lose the license to operate from key stakeholders. It will succumb to short-term pressures to distribute earnings, and, in the process, sacrifice investments in employee development, innovation, and capital expenditures that are necessary for long-term growth. It will remain exposed to activist campaigns that articulate a clearer goal, even if that goal serves only the shortest and narrowest of objectives. And ultimately, that company will provide subpar returns to the investors who depend on it to finance their retirement, home purchases, or higher education.

It’s clear that at least some shareholders care about learning what a company think its “purpose” is – so it’s one of those things that should be highlighted in the proxy.

For example, see the 2023 proxy for Elevance Health (on page 6):

And see the 2023 Lumen proxy (on the inside front cover):