Disclosure around companies’ recoupment policies slowly have evolved from a high-level bullet in the “what we do” list of compensation best practices to a summary of key terms, mostly to satisfy investor inquiries into whether the policy covers any unearned compensation (e.g., due to an accounting restatement) and/or whether forfeiture is required in situations arising from employee actions. With requirements stemming from Dodd-Frank and related exchanges to adopt compliant recovery policies by December 2023, more robust disclosures were found in the wave of 2024 proxies.

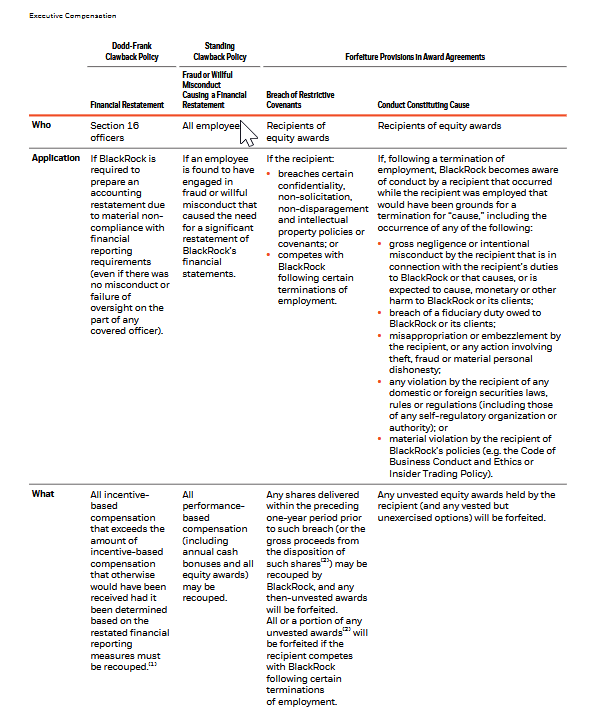

Many companies adopted a second policy to comply with the new rules, but also maintained their existing policy, requiring an explanation of the overlap and differences.

Here’s an example from the 2025 BlackRock proxy:

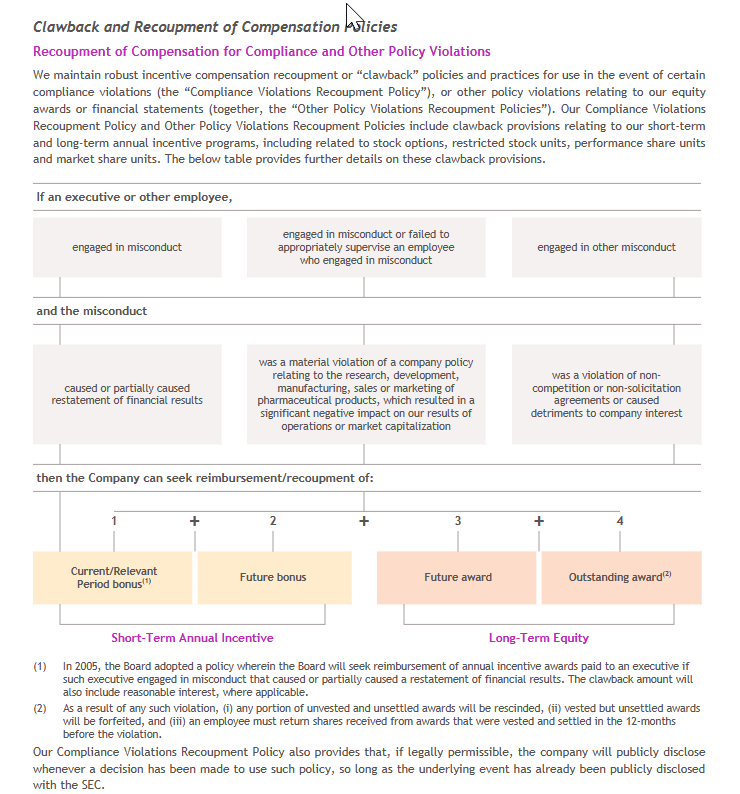

And here’s an example from the 2025 Bristol Myers Squibb proxy: