As T. Rowe Price’s Donna Anderson recently noted in my interview with her, she is always kind of surprised at the number of companies – including big companies – that still don’t have any kind of letter or remarks from the lead independent director or the chair of the board up front in the proxy. These companies don’t give any context in the proxy for the nature of their business – instead, they just go straight into ‘here’s how you should vote’ and ‘here’s who we’re nominating.’

Investors are looking for information about how does the board think we did this year. It also serves to help to make it clear to the reader that the board has ownership over that message and has their own voice.

There are some companies that do this well. One example is this letter from the GE Aerospace board in their 2025 proxy:

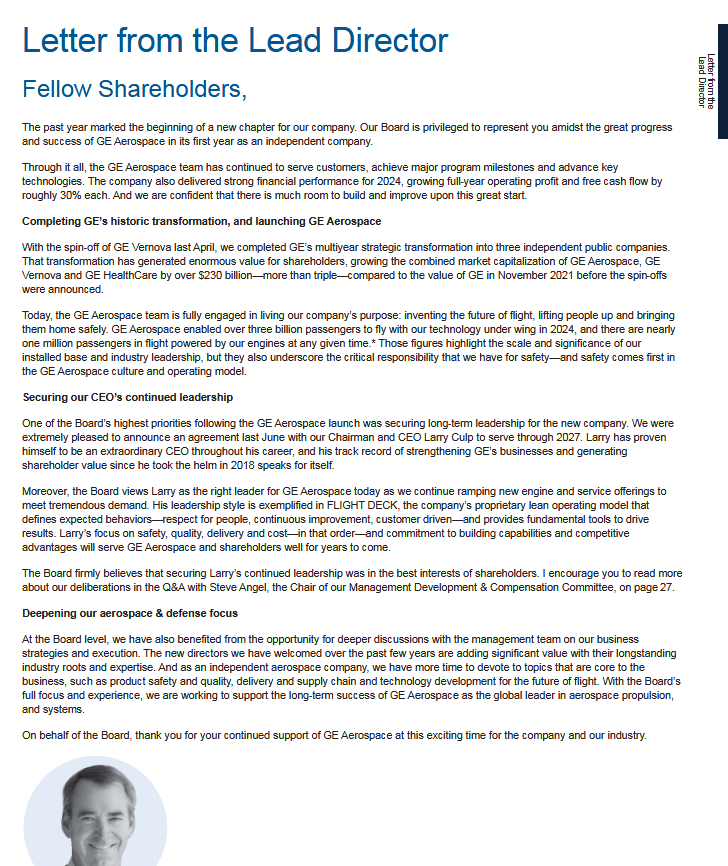

Another is this example from Halliburton in their 2025 proxy in which the Chair of the Compensation Committee described a complex compensation situation through a set of Q&As: