Director nomination disclosures historically have focused on the nomination and corporate governance committee’s recommendation of the slate of nominees for election. Often this section includes a statement that the committee annually considers the current composition of the board, as well as ongoing consideration of the board’s collective skills and needs in light of the company’s near and long-term strategic ambitions.

Many proxies then move directly into disclosure about the process for identifying new director candidates. More recently, however, companies are sharing more detail about how they consider the renomination of incumbent directors, with some companies emphasizing that re-nomination is not automatic.

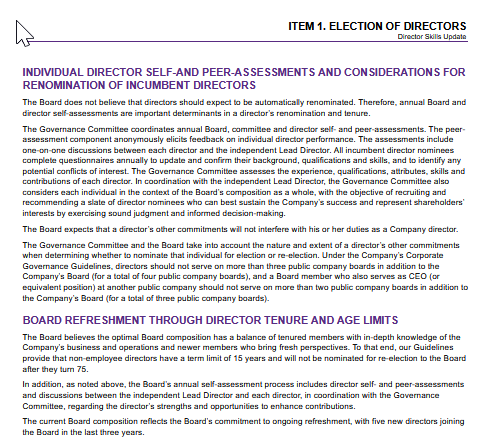

Here’s an example from the 2025 JPMorgan Chase proxy:

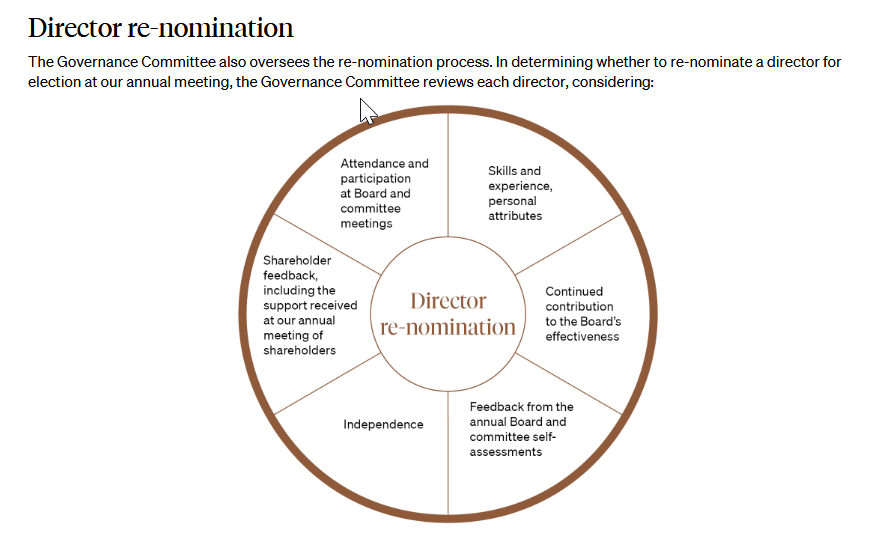

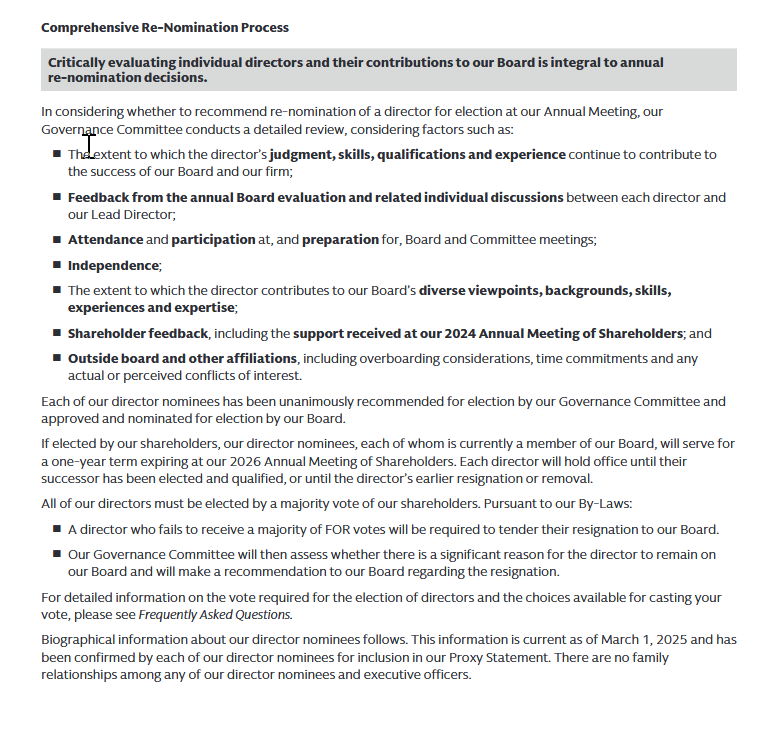

And here’s an example from the 2025 Goldman Sachs proxy:

And here’s an example from the 2025 Mondelez proxy: