Remember when most proxies discussed board oversight only in the context of risk? Although not required, it is now common practice to discuss the board’s responsibilities more broadly, including at a minimum the board’s role with respect to strategy and CEO succession planning. Insight into the board’s approach to oversight of specific topics are also frequent disclosures. According to Labrador’s recent benchmarking, approximately three-quarters of companies include a section, subsection or callout discussing the board’s role in ESG oversight in the proxy statement.

This disclosure is often accompanied by a visual element depicting the distribution of specific sustainability-related topics among the board and board committees. Inclusion of the governance framework supporting key initiatives can also be helpful – for example, the board oversight graphic may also include cross-functional management and operating committees tasked with day-to-day ESG responsibility.

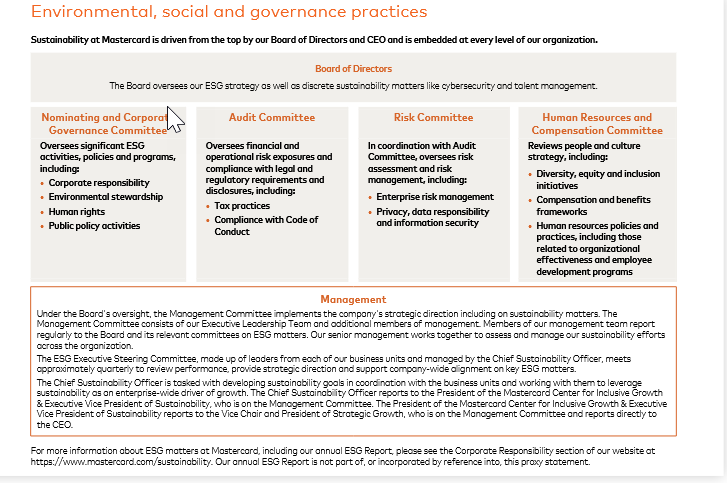

Here’s an example from the 2024 Mastercard proxy:

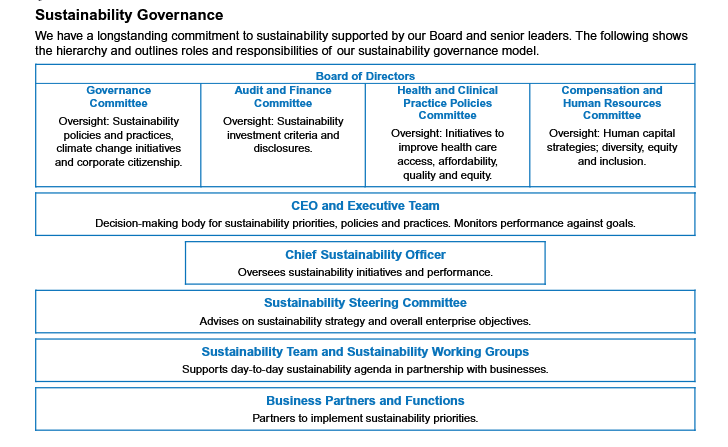

And here’s an example from the 2024 UnitedHealth Group proxy: